Navigating the Maze: Understanding Your Health Insurance Coverage

Health insurance. The very phrase can evoke a shudder, conjuring images of dense paperwork, incomprehensible jargon, and a frustrating search for answers. But understanding your health insurance isn’t just about deciphering hieroglyphics; it’s about safeguarding your financial well-being and ensuring access to the healthcare you need. This guide will help you navigate the labyrinth, empowering you to become a savvy consumer of your own healthcare.

Decoding the Jargon: Key Terms Explained

Before we delve into the intricacies, let’s equip ourselves with the essential vocabulary. Think of this as your decoder ring for the insurance world:

| Term | Simple Explanation |

|---|---|

| Premium | Your monthly payment for coverage. |

| Deductible | The amount you pay out-of-pocket before your insurance kicks in. |

| Copay | A fixed fee you pay for a doctor’s visit or other service. |

| Coinsurance | Your share of the costs after you’ve met your deductible. |

| Out-of-Pocket Maximum | The most you’ll pay out-of-pocket in a year. |

| Network | The doctors and hospitals your insurance covers at in-network rates. |

The Great Insurance Landscape: Choosing the Right Plan

The health insurance market is a vast and varied landscape, with numerous plans catering to different needs and budgets. Understanding the different types of plans is crucial for making an informed decision:

HMO (Health Maintenance Organization)

Think of an HMO as a tightly knit community. You typically need a primary care physician (PCP) who acts as your gatekeeper, referring you to specialists within the network. This often leads to lower premiums, but limited choices outside the network.

PPO (Preferred Provider Organization)

PPOs offer more flexibility. You can see specialists without a referral, and you can see out-of-network doctors, although it will cost you more. Premiums are generally higher than HMOs.

EPO (Exclusive Provider Organization)

An EPO is a hybrid, offering something between an HMO and a PPO. You don’t need a referral to see specialists, but you’re limited to in-network providers. Out-of-network care is typically not covered.

HSA (Health Savings Account)

HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses. They’re often paired with high-deductible health plans, offering significant savings potential in the long run.

Beyond the Basics: Navigating the Fine Print

Understanding your policy’s specifics is paramount. Don’t be afraid to delve into the details, paying particular attention to:

- Coverage for pre-existing conditions: Ensuring your plan covers any pre-existing health issues.

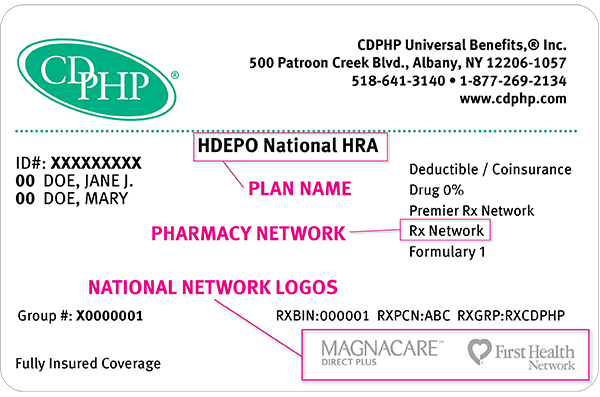

- Prescription drug coverage: Understanding formularies (lists of covered medications) and their cost-sharing.

- Mental health and substance abuse benefits: Verifying comprehensive coverage for these vital aspects of healthcare.

- Appeals process: Knowing how to dispute a claim denial.

Mastering Your Healthcare: Proactive Steps

Being proactive is key to managing your healthcare effectively. Consider these steps:

- Review your Explanation of Benefits (EOB): Understand what services were billed and what your insurance covered.

- Ask questions: Don’t hesitate to contact your insurance provider or your doctor’s office if something is unclear.

- Maintain accurate records: Keep copies of your policy, EOBs, and other important documents.

- Utilize online portals: Many insurance providers offer online portals where you can manage your account, view claims, and communicate with customer service.

The Journey to Healthcare Clarity

Navigating the world of health insurance can feel like traversing a complex maze, but with the right tools and knowledge, it becomes significantly more manageable. By understanding the key terms, choosing the right plan, and engaging proactively with your insurance provider, you can empower yourself to make informed decisions about your healthcare and your financial well-being.

Additional Information

Navigating the Maze: A Deeper Dive into Understanding Health Insurance Coverage

The initial article on understanding health insurance coverage likely provided a foundational overview. This analysis delves deeper, exploring nuanced aspects often overlooked by consumers, highlighting the complexities and offering strategic approaches to navigate the system effectively.

1. Beyond the Premium: Unpacking the Cost of Healthcare:

While the monthly premium is the most visible cost, understanding the true cost of healthcare requires analyzing several components:

-

Deductibles: This upfront cost, often thousands of dollars, must be met before insurance begins paying for services. A high deductible plan may seem cheaper initially, but can lead to significant out-of-pocket expenses for unexpected illnesses or injuries. Consider a hypothetical scenario: A family with a $10,000 deductible faces a $15,000 hospital bill. They are responsible for the full $10,000, even with comprehensive coverage. This highlights the importance of emergency funds and the potential need for supplemental insurance.

-

Co-pays and Co-insurance: Co-pays are fixed fees paid at the time of service, while co-insurance is a percentage of the cost you pay after meeting the deductible. Understanding these percentages is crucial. A 20% co-insurance on a $5,000 procedure means a $1,000 out-of-pocket expense after the deductible. These costs can add up quickly, especially with multiple medical needs.

-

Out-of-Pocket Maximum: This is the most you will pay out-of-pocket in a plan year. While it provides a ceiling on expenses, reaching this limit can still be financially devastating. Knowing this limit and actively tracking your expenses is essential.

-

Network Providers: In-network providers have negotiated rates with your insurance company, resulting in lower costs. Using out-of-network providers can dramatically increase your out-of-pocket expense. Verifying provider participation before seeking care is vital.

2. Decoding Plan Types and Choosing the Right Fit:

The market offers diverse plan types, each with trade-offs. A simple comparison of premiums isn’t sufficient. Consider:

-

HMO (Health Maintenance Organization): Requires choosing a primary care physician (PCP) who coordinates care. Referrals are usually needed to see specialists. Generally lower premiums but restricted network access.

-

PPO (Preferred Provider Organization): Offers more flexibility to see specialists without referrals and access to a wider network. Premiums are typically higher, and out-of-network costs can be significant.

-

EPO (Exclusive Provider Organization): Similar to HMOs but with slightly more flexibility. Out-of-network benefits are extremely limited or non-existent.

-

HSA (Health Savings Account)-compatible Plans: High-deductible plans paired with an HSA allow pre-tax contributions to save for medical expenses. This offers tax advantages but requires responsible financial planning.

Choosing the right plan requires a careful assessment of individual health needs, risk tolerance, and financial capacity. A family with chronic conditions will benefit differently from a plan than a healthy young adult.

3. Navigating the Appeals Process:

Insurance denials are a frequent source of frustration. Understanding the appeals process is crucial. Most plans have multiple levels of appeal, often involving detailed documentation and potentially involving an independent review. Knowing your rights and having a systematic approach to appeals can be the difference between significant financial burden and successful resolution.

4. The Impact of Pre-existing Conditions:

The Affordable Care Act (ACA) prohibits discrimination based on pre-existing conditions. However, understanding how these conditions might impact premiums and coverage is still essential. While coverage is guaranteed, some plans might have higher premiums for individuals with specific health issues.

5. Leveraging Technology and Resources:

Several online tools and resources can help simplify the process:

- Healthcare.gov: A centralized website for finding and comparing plans in the ACA marketplace.

- Your Insurance Provider’s Website: Provides access to member portals, explanation of benefits (EOB), and claims information.

- Independent Health Insurance Brokers: Can offer unbiased guidance in navigating the complexities of health insurance.

Conclusion:

Understanding health insurance coverage is a continuous process requiring proactive engagement. By understanding the detailed costs, plan types, and appeals processes, individuals can make informed decisions, mitigate financial risks, and ultimately navigate the maze of healthcare financing more effectively. Regularly reviewing your coverage and proactively engaging with your insurer is essential for maximizing the benefits and minimizing unexpected expenses.